Synopsis: Process Equipment – Segmentation Strategy

A process equipment manufacturer turned to QDI to evaluate its existing channel structure’s ability to deliver long-term growth. Their markets were typical in that they were comprised of MRO, retrofit and new construction sales. They wanted to understand how effective and cost-efficient their channels were in each of these sales scenarios.

Through primary research with distributors QDI consultants developed an understanding of how distributors approached each of these market segments as well as their margin requirements for each type of sale.

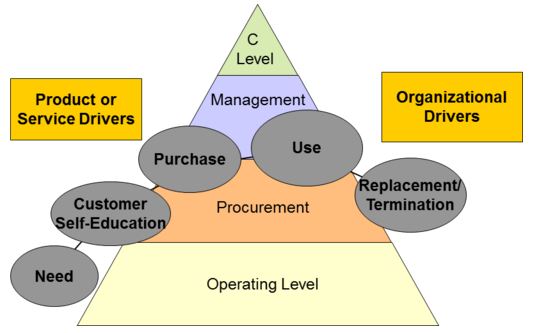

Through the end-user research, we explored how end users made their purchase decisions in each of these categories. QDI consultants mapped out the customer journey to understand how customer came to see a need, educated themselves, made the purchase, and then used and ultimately replaced or terminated use of the product. The graphic below depicts the model and sows that QDI holds discussions throughout the organization to understand both what drives the decision to purchase a specific product or service and how different function in the organization impact this process.

As expected, the replacement purchases were like-for-like as the cost and risk of change was much higher than any potential savings. The project purchases were a design / build engineering sale and the engineering firms had relationships with both distributors and manufacturers that created high visibility to these sales for our client.

The challenge and the real insight that came out of the research was the understanding of the customer behavior during a retrofit sale. Retrofits took place when minor process changes were taking place or when there were problems with the performance of the existing system. Visibility to these events was key to winning these sales and this visibility was very low.

The end user research showed that our client was present and known by about half of the customer our consultants interviewed. Thus, half of the market relied totally on the distributor to present our client’s offerings to the customer.

Research with the distributors and end users showed that the client’s distributors did see this business, but their job was to help customers solve problems, not sell any specific company’s products. When the distributor sales rep perceived your products met the customer’s need, you were presented – assuming the distributor sales rep has the knowledge and motivation to do so.

Further discussions with distributors showed that they perceived our client’s technical support as only average. Thus, the likelihood that the distributor would present the client’s products and rely on our client’s technical support with the account was minimal.

With this understanding QDI recommended three primary actions to target plant project sales:

- Create web based Application Support and Inventory Availability

- Provide web-based application support to let the end user see his options quickly, so that the distributor is not the only source of technical support information for these sales.

- Provide web-based inventory support so customers know if the product they need is available now, as several of these retrofits are quick turn-around projects

- Increase the technical support and responsiveness to distributors so they can learn to rely on the client for support on plant project sales

- Broaden product mix related to current products to become a more important supplier to these distributors which will lead to a greater ability to influence the distributor’s investments in training and increase the distributor sales reps’ visibility to when you “fit” the customer’s needs.