Synopsis: Power Transmission – New Market Entry

A major power transmission equipment manufacturer came to us with a new product concept that combining the most innovative technologies across the company. The manufacturer was at a stage gate review and had to answer the question, “Does the market opportunity warrant further investment?” Working with set of potential benefits the project team identified, QDI consultants went into the market and spoke with plant maintenance engineers, corporate engineering and purchasing groups. Our objective was to determine the value of this product concept with different customer segments and to quantify the size of the opportunity for each segment.

Initially the prospects showed little interest in the new product. As we explored why the potential buyers said they had seen many of the benefits before. The add-on gadgets that delivered these benefits were not always reliable so the engineers doubted the client’s claims. Had the research ended there the team would have had to kill the concept.

In a joint QDI/product team work sessions some engineers felt that if the people we interviewed understood the new materials and the design they would have been much more interested. Because of the market competitiveness the client wasn’t willing to openly discuss the design. We decided to revise the research protocol such that if an interviewee was willing to sign a non-disclosure agreement we would share with them additional specifications.

In one of the key segments a few large customers, representing a major portion of the market, agreed to sign the non-disclosure agreement. Through follow on phone and face-to-face interviews we learned that when the prospect saw the materials and design they were very interested. Some becoming test sites for the new product because they wanted to speed adoption within their firm.

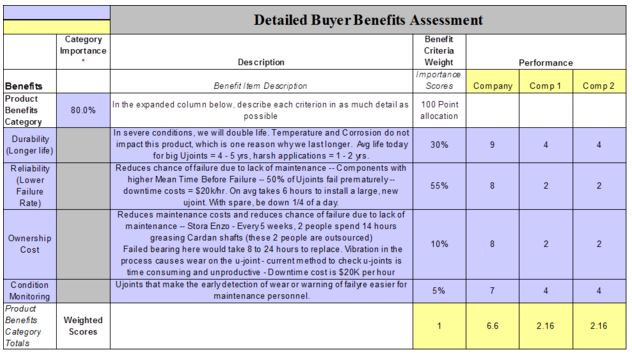

QDI consultants used QDI’s Value Assessment Model to help define and quantify the specific product benefits that related to durability, reliability, ownership cost and condition monitoring that we were learning in our discussions with these key customers. As the exhibit below shows, we specifically defined the benefit in a way it could be quantified and compared to competitive alternative, which are scored below.

The breakthrough came when we also learned when these firms saw the new material and the lighter weight they knew it would simplify the installation process saving time during their time sensitive annual plant shutdown. When we added this new benefit to the interview process all but one segment saw significant value in the new concept. Thus, in the table above, the fact that we can reduce the time to install a spare was a significant portion of the 55% of benefits the customer perceived.

Using QDI’s Value Management Model, our consultants determined the proposed offering ranged from 80% to 280% of the value of existing alternatives and that the overall potential for this new offering was in excess of $325 million.

QDI’s research that looked at how customer purchased these types of products showed that about one-third of this potential was available through the existing marketing organization. To compete for the remainder of the market, QDI identified acquisition strategies that would make our client’s offerings worth at least 20% more than any competitive alternative.

QDI provided the data and insight the client’s project team needed to validate movement to the next step in their stage gate process.